A new wave of cybersecurity IPOs is anticipated over the next 12 to 18 months. The recent entry of SailPoint served as an initial test, and despite a muted first-day performance, the subsequent upward trajectory of its share price suggests a positive outcome.

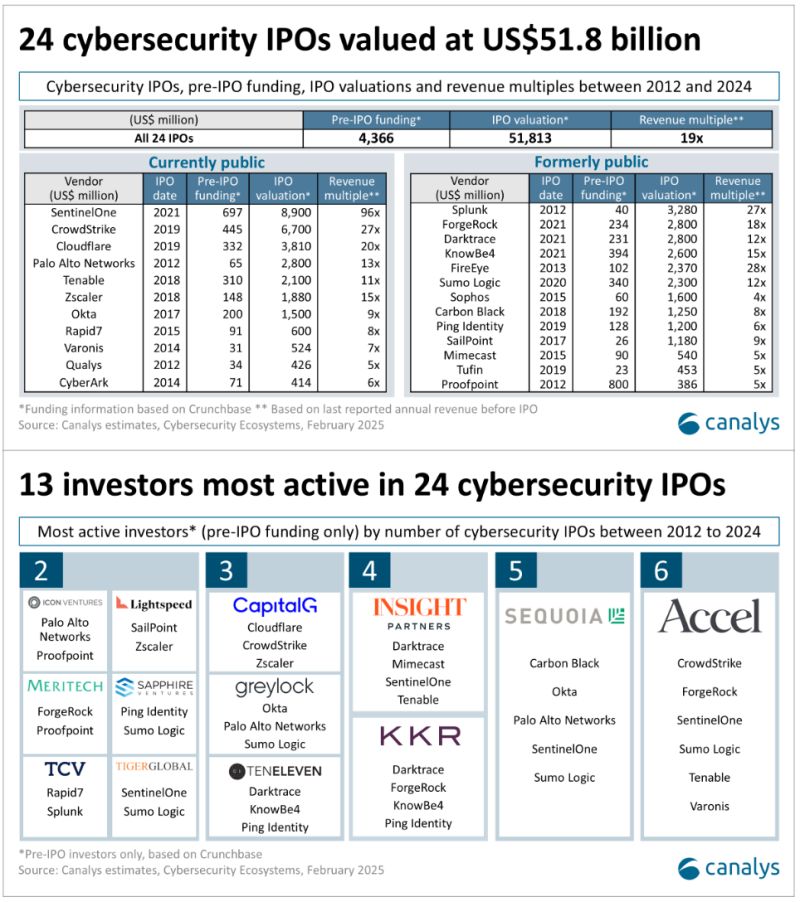

Canalys (now part of Omdia) analyzed 24 previous cybersecurity IPOs between 2012 and 2024 to spotlight the most active investors that funded those vendors’ growth and their subsequent performance post-listing. The results were mixed:

• The 24 vendors collectively were valued at US$51.8 billion at IPO and raised a total of US$6.1 billion in funding. SentinelOne (US$1.2 billion), CrowdStrike(US$612 million) and Cloudflare (US$525 million) were the top three in terms of IPO funding. SailPoint surpassed them all by raising US$1.3 billion.

• In the lead up to their IPOs, the 24 vendors secured US$4.4 billion in pre-IPO funding. SentinelOne (US$697 million), CrowdStrike (US$445 million) and Tenable (US$310 million) led the way. The current three most funded pre-IPO vendors are Wiz (US$2.0 billion), Netskope (US$1.4 billion) and Snyk (US$1.2 billion).

• More than 150 different investors provided funding in the lead up to the 24 IPOs. Accel, Sequoia Capital, Insight Partners, Kohlberg Kravis Roberts & Co. L.p. had invested in four or more of them. These plus others like Lightspeed, Coatue, ICONIQ Growth, and Andreessen Horowitz, are among the most active in the next wave of potential IPOs, and will be looking for a return on their collective (all investors) US$63.5 billion of pre-IPO cybersecurity vendor funding since 2020.

• 13 of the 24 vendors have either been acquired or gone private. Splunk and Carbon Black were acquired by Cisco and VMware for a combined value of US$30.2 billion. The remaining 11 were acquired in take-private deals totalling US$47.4 billion. Like with SailPoint, this allows vendors to invest in longer-term strategies free from the scrutiny of quarterly reporting.

• Thoma Bravo took six vendors private (ForgeRock, Ping Identity, Darktrace, Proofpoint, SailPoint and Sophos) for US$33.5 billion. Permira (Mimecast), STG – Symphony Technology Group (FireEye), Vista Equity Partners (KnowBe4), Francisco Partners (Sumo Logic) and Turn/River Capital (Tufin) were also active. The Thoma Bravo and Permira assets are most likely to follow SailPoint and return to being publicly listed.

• The 11 remaining publicly listed vendors form part of Canalys’ Cybersecurity Titans Index Palo Alto Networks is the leading vendor. CrowdStrike, Zscaler, Cloudflare, CyberArk, SentinelOne and Varonis are all growing +20%, with Okta and Tenable growing way above +10%.