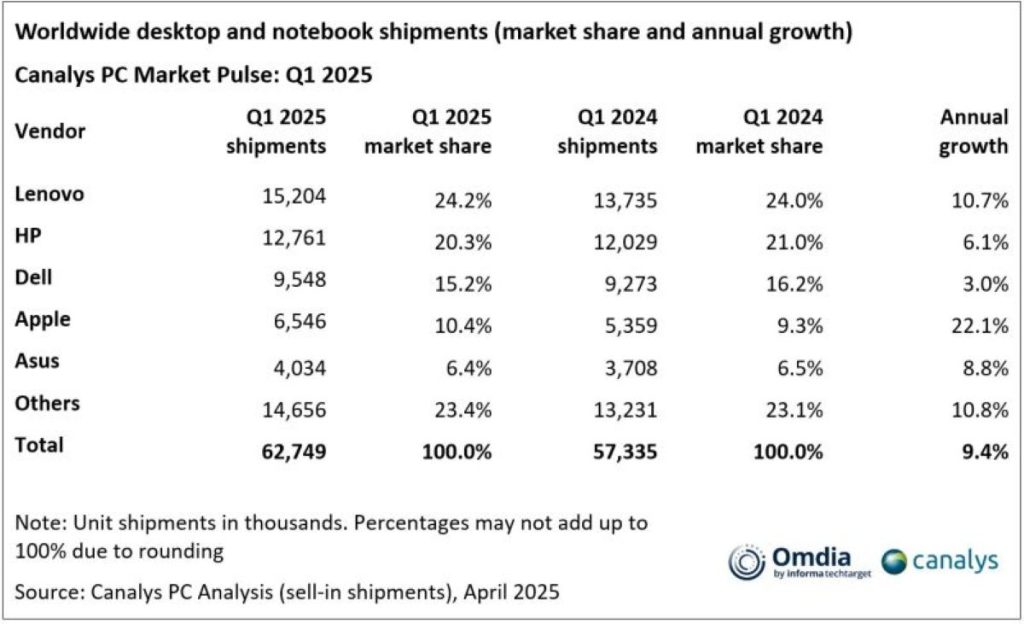

According to the latest data from Canalys, now part of Omdia, total shipments of desktops, notebooks and workstations grew 9.4% to 62.7 million units in Q1 2025. Notebook (including mobile workstations) shipments hit 49.4 million units, up 10% compared to a year ago. Shipments of desktops (including desktop workstations) rose 8% to 13.3 million units. Q1 volumes were boosted by OEMs ramping up shipments to the US in anticipation of the first round of the Trump administration’s tariff announcements. As the next round of higher tariffs on more countries goes into effect, both direct and indirect impacts threaten global PC market recovery and Windows 10 End of Support induced momentum for the remainder of the year.

“PC shipments experienced a surge in Q1 2025, driven by vendors accelerating deliveries to the US in anticipation of initial tariff announcements,” said Ishan Dutt, Principal Analyst at Canalys, now part of Omdia. Lenovo and HP grew shipments to the US in Q1 by around 20% and 13%, respectively. “This preemptive strategy allowed manufacturers and the channel to stock up ahead of potential cost increases, boosting sell-in shipments despite otherwise stable end-user demand,” added Dutt. “Although similar steps are being taken regarding the broader tariffs set to kick in on 9 April 2025, subsequent quarters this year are likely to see a slowdown as inventory levels normalize and customers face higher prices.”

The impact of tariffs on consumer demand is expected to be greater, as purchasing a more expensive PC will need to be prioritized against other spending categories also facing price increases. Businesses, especially SMBs, will also face some pressure that could slow down momentum for the critical transition away from Windows 10 ahead of the October 2025 End-of-Support (EOS) date. “A Canalys (now part of Omdia) March poll of channel partners who are familiar with SMB PC refresh plans revealed that 14% say their customers are not aware of Windows 10 EoS and a further 21% say their customers are aware but have no plans to upgrade,” said Dutt. “For customers in these situations, the delay in planning means they are likely to face a higher cost environment when the time comes to refresh their PC fleets.”

From a production perspective, major OEMs already began supply chain diversification during Trump’s first term and are expected to continue moving away from China towards Vietnam, Thailand, and India, despite these countries also facing the imposition of tariffs. By the end of 2025, most major PC vendors are expected to have completed the shift of US-bound shipments out of China, aiming to enhance supply chain resilience and mitigate the impact of tariffs. For example, in their latest earnings call, HP CEO Enrique Lores stated that 90% of the company’s products sold in the US would be made outside of China by the end of this year. “Although these major manufacturing countries have been targeted with tariffs, their rates remain relatively competitive compared to China’s,” said Ben Yeh, Senior Analyst at Canalys, now part of Omdia. “Moreover, these countries have shown a willingness to negotiate, raising the possibility that the tariffs may eventually be reduced or waived, while China has responded swiftly with a new round of reciprocal tariffs. As a result, production relocation plans are still ongoing and are unlikely to change significantly before further implementation details are announced.”

In Q1 2025, Lenovo maintained its lead in the global PC market, shipping 15.2 million notebooks and desktops and achieving strong growth of 11%. Second-placed HP grew its shipments 6% annually, hitting 12.8 million units. Following several quarters of year-on-year declines, Dell achieved 3% growth, shipping 9.5 million units in Q1. Apple secured fourth place with strong shipment growth of 22%, shipping 6.5 million units and capturing 10.4% market share. Asus rounded out the top five rankings with 9% growth and 4.0 million units shipped.