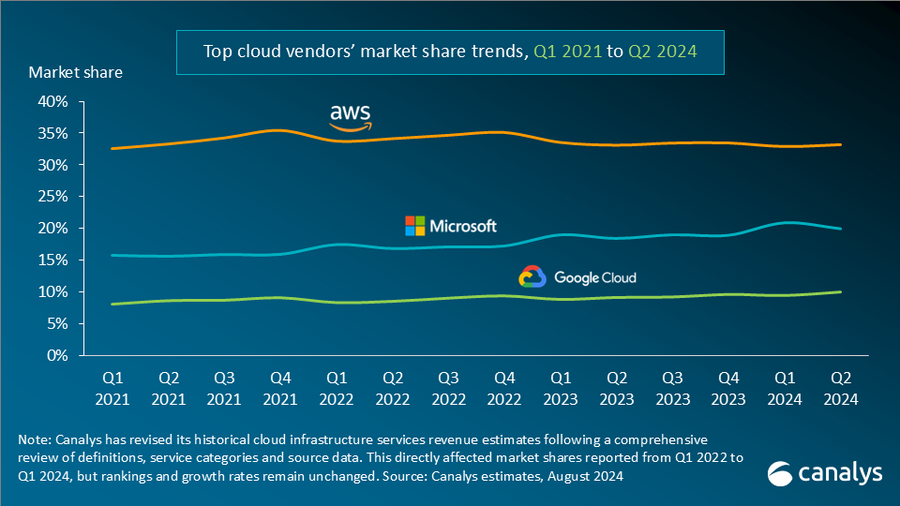

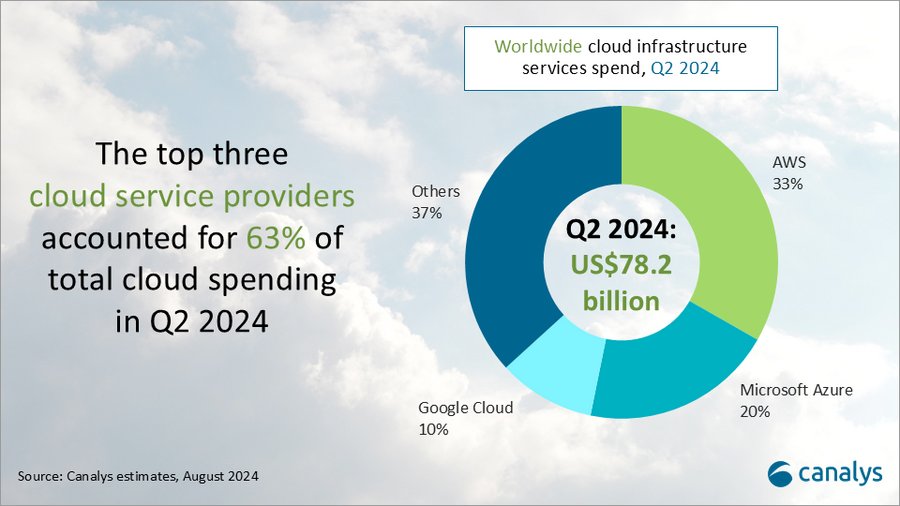

In Q2 2024, global spending on cloud infrastructure services grew 19% year on year to reach US$78.2 billion. While enterprises’ IT budgets have returned to growth, a significant portion of spending is now directed toward AI-related investments. The top three vendors – AWS, Microsoft Azure and Google Cloud – collectively grew by 24% this quarter to account for 63% of total spending. AWS showed a notable increase in growth compared with the previous quarter, with Q2 sales up 19%. Meanwhile, Microsoft Azure and Google Cloud continued to show robust double-digit growth, up 29% and 30% respectively. Over a third of cloud market share globally is still held by other cloud providers, but the market is shifting toward the top hyperscalers, which are capturing an increasing share of the market.

Canalys has revised its historical cloud infrastructure services revenue estimates following a comprehensive review of definitions, service categories and source data. This directly affected market shares reported from Q1 2022 to Q1 2024, but rankings and growth rates remain unchanged.

Accelerating demand for AI is expected to generate significant opportunities for sustained growth in cloud services. As enterprises adopt AI technologies, they will need more advanced and scalable cloud infrastructure, driving ongoing investment and development in cloud services. But concerns are emerging regarding potential over-investment in AI, as returns appear to be taking longer than initially anticipated. Despite these concerns, hyperscalers continue to increase their investments in AI – all three of the top hyperscalers ramped up their capital expenditure on data centers by tens of billions of dollars in the quarter – recognizing that overestimating investment risks may be more detrimental than underestimating them.

All three hyperscalers reported a significant surge in the number of customers using AI. They continue to introduce new AI products, such as Google Cloud’s Gemini 1.5 and Azure’s GPT-4o mini. AWS, through its cloud platform Bedrock, also offers Claude 3.5 Sonnet and other APIs.

“Commercialization of new technologies doesn’t happen overnight,” said Alex Smith, VP at Canalys. “The future of cloud computing remains promising. In the face of transformative tools like AI, the main providers will invest for fear of missing out. AI relies on large-scale computing power and storage, and the hyperscalers hope that AI-powered services become the next compelling reason for customers to transition to the cloud.”

In addition to launching new AI products and solutions, hyperscalers are intensifying efforts to strengthen their AI partner ecosystems. This quarter, leading vendors are placing particular emphasis on fostering AI startups. Notable initiatives include AWS’ Generative AI Accelerator and Google Cloud’s Google for Startups Accelerator, both aimed at engaging AI startups and driving innovation within the industry.

“Startups bring fresh perspectives, agility and specialist expertise, providing hyperscalers with opportunities to tap into emerging markets, address technological gaps and acquire new talent,” said Yi Zhang, Analyst at Canalys. “By supporting startups, hyperscalers ensure that even smaller companies can contribute to and benefit from the rapid advances in AI technology, ultimately driving growth, strengthening their ecosystems and maintaining their competitive edge in the industry.”

- Amazon Web Services (AWS) continued to lead the global cloud market, holding a 33% market share in Q2 2024. Its year-on-year revenue growth rate increased to 19% this quarter, with its performance strengthening on the previous quarter. Its backlog reached US$156.6 billion, representing an annual increase of 19%. Through its Bedrock platform, AWS introduced new APIs for foundational models, such as Claude 3.5 Sonnet and Llama 3.1. Bedrock, entirely cloud-based, enables enterprises to develop their own foundational models, which have served tens of thousands of active customers. AWS places significant emphasis on the integration and development of AI within its partner ecosystem. In June 2024, it announced a US$230 million commitment to its Generative AI Accelerator program, aimed at helping global startups accelerate AI application development. Additionally, AWS introduced changes in June, including enhanced technical support, discounts for MSPs and lower requirements for service partners. These adjustments are designed to strengthen AWS’ partner ecosystem by making it more accessible and beneficial for a broader range of partners.

- Microsoft Azure ranked as the second-largest provider in the cloud services market, holding a 20% share with 29% annual growth. Microsoft claimed that AI services contributed 8% of Azure growth in Q2 2024, up from 7% the previous quarter. With access to cutting-edge models, Azure AI attracted over 60,000 customers, reflecting nearly 60% year-on-year growth. In response to this demand, Microsoft has released or upgraded several models, including the large language model GPT-4o mini and the small language model Phi-3 Vision. Microsoft Azure continues to expand its data center footprint, announcing significant investments in Malaysia, Spain and the United States. These investments include infrastructure development and initiatives aimed at enhancing AI skills.

- Google Cloud was the third largest provider, holding a 10% market share with a year-on-year growth rate of 30%. As of 30 June 2024, Google Cloud’s revenue backlog reached US$78.8 billion, an increase from US$72.5 billion in Q1 2024. By the end of Q2, Google Cloud’s AI infrastructure and generative AI solutions – such as Vertex AI, Gemini for Workspace and Gemini for Google Cloud – had generated billions in revenue and were used by over 2 million developers. Gemini delivers highly valuable features across products such as Search, Workspace and Google Messages, and is integrated into six products, each boasting over 2 billion monthly active users. In June 2024, Google Cloud introduced channel private offers through the Google Cloud Marketplace, facilitating efficient transactions for third-party solutions and enabling channel partners to manage customer relationships from billing to revenue recognition. Additionally, Google announced the opening of its first data center and cloud region in Malaysia, alongside expansions in Iowa, Virginia and Ohio.